US Education Regulations: Key Changes in Last 3 Months

The US Department of Education has implemented significant regulatory changes in the last three months, impacting financial aid, institutional accountability, and student protections, requiring stakeholders to understand these pivotal updates for compliance and planning.

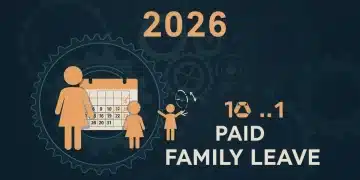

2026 Paid Family Leave Benefits: Your Guide to 12 Weeks Protected Time Off

The 2026 Paid Family Leave benefits provide eligible employees with up to 12 weeks of protected time off to care for a new child, a seriously ill family member, or manage personal health conditions, ensuring financial security during critical life events.

National Energy Outlook 2026: 10% Surge in Renewable Energy Adoption

The National Energy Outlook 2026 projects a substantial 10% increase in renewable energy adoption by mid-year, driven by policy support, technological advancements, and growing environmental awareness across the United States.

Digital Currencies 2026: 6-Month Outlook & Investment Opportunities

The future of digital currencies for 2026 presents a dynamic landscape shaped by evolving technology, regulatory frameworks, and increasing institutional adoption, offering diverse investment opportunities.

Online vs. In-Person Higher Education US: Data for 2026

Comparing online vs. in-person higher education in the US for 2026 reveals critical data-backed insights into evolving student preferences, technological advancements, and shifting institutional strategies impacting accessibility and learning outcomes.

2026 Commuter Benefits: Cut Monthly Travel Costs by $100

Navigate the latest 2026 commuter benefits to significantly reduce your monthly travel expenses. This comprehensive guide details new provisions, eligibility, and strategies to save up to $100, enhancing your financial well-being.